BlackHoleDAO is a decentralized asset administration protocol primarily based on DAO governance. “BlackHole DAO Protocol (BHDP)” is a model new standardized mannequin constructed primarily based on DeFi 3.0. The BHDP burn mechanism, by drawing on the inventory cut up and inventory merge within the conventional inventory market, resolves the imbalance between excessive inflation and deflation available in the market. It additionally rolls out the DAOs credit-based mortgage service.

1.0 BHDP Parts

1.1 BHDP Design Highlights

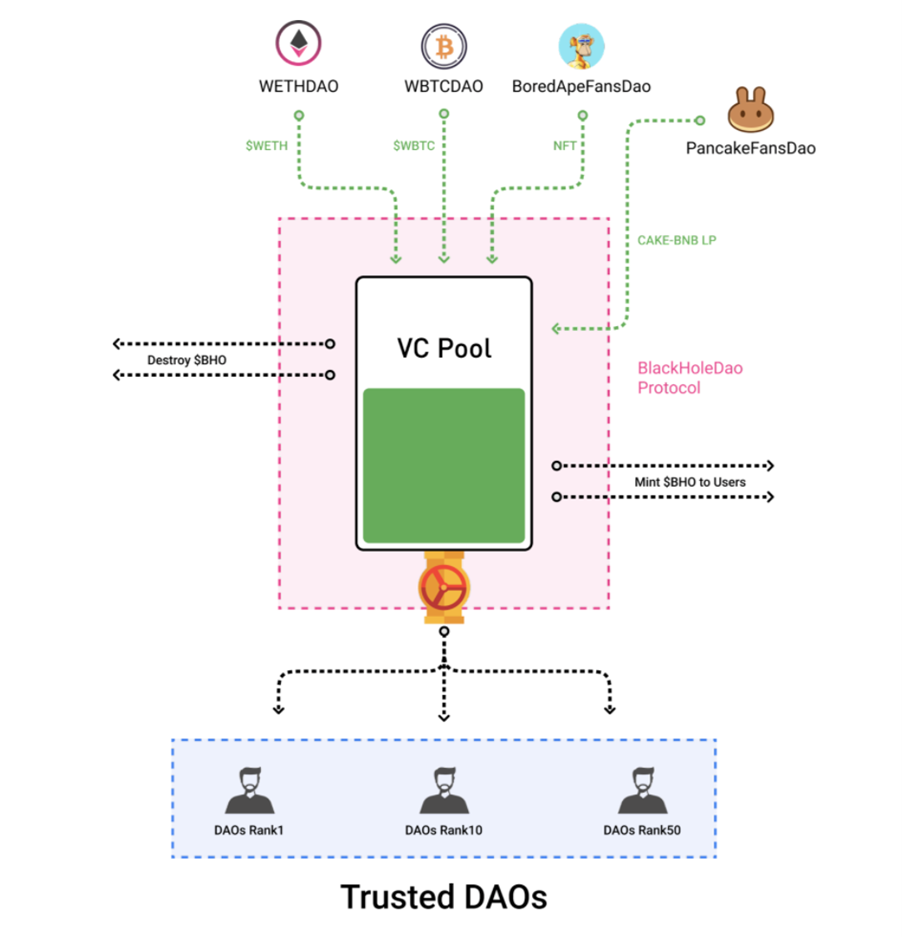

From the above image, BHDP (BlackHole DAO Protocol) is supported by a Treasury, with sensible contracts to attach VC Pool and Donation Pool. VC Pool helps multi-asset certificates investments, a part of which is used to burn BHO within the liquidity pool and the remaining for credit score loans after the DAOs funding succeeds.

3 BHDP Methods of Deflation:

- It’s a frequent option to burn straight 60% BHO of the transaction tax

- 50% of VC Pool can also be used to burn BHO within the liquidity pool,

- The BHDP excessive deflation mechanism will likely be triggered when the acute inflation occurs:

When the inventory (BHO) available in the market reaches a specific amount with a 0 assist price, the deflation mechanism will likely be triggered. The curiosity on Stake will progressively lower by a proportion.

X-[X/(Y*H)]=Z

x: quantity when the burn mechanism is triggered

y: burn price

h: Time (days)

z: quantity remained when the assist price is bigger than 0

2.0 Clever Use of Olympus Stake and Bond

2.1 Developed Stake and Bond

BlackHole DAO Stake regulates minting dynamically by the proportion of the entire staking quantity. In different phrases, when the market is in inflation, the staking curiosity will lower, whereas in deflation, it’s going to enhance. Nevertheless, it’s going to by no means exceed the entire staking quantity. The benefit of dynamic regulation is, this free market transaction prevents the collective habits to flee after making a revenue.

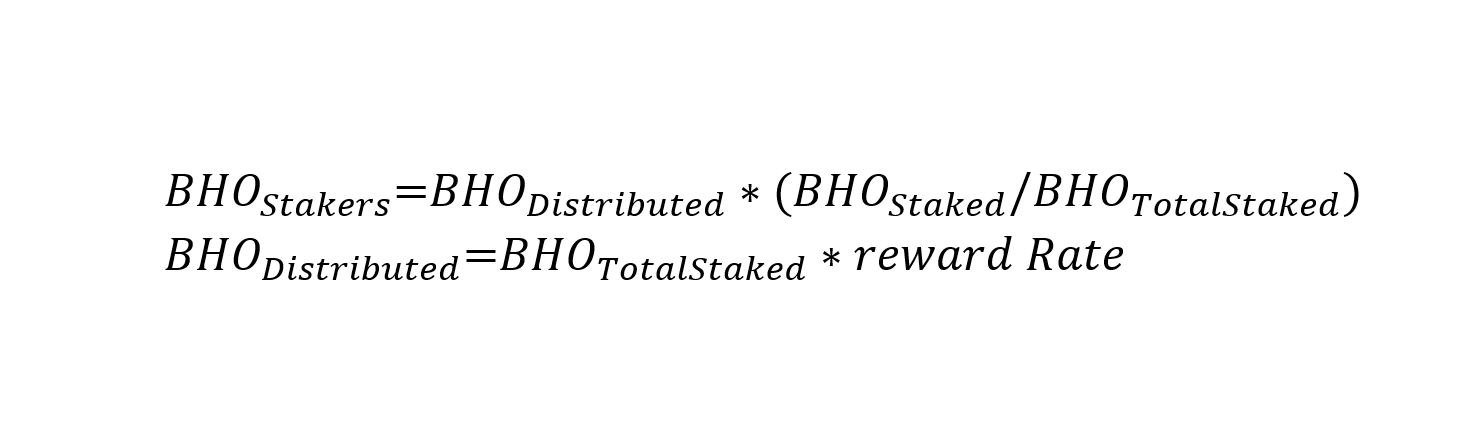

Staking reward is calculated as:

Enhancements:

Enhancements:

- Olympusdao can mint tokens on a regular basis, whereas BlackHole DAO dynamically regulates the proportion of minted tokens in response to the inflation price. In a comparatively excessive inflation price, the proportion of BHO minted by Bond will lower. Upon a 0 assist price, Bond will cease minting.

- It gives a reduction to purchase Tokens by way of Olympusdao, whereas to purchase Tokens by way of BlackHole DAO is identical because the market worth, however saves 15% of transaction tax.

For each selections, essentially the most worthwhile level is that when the market circulation worth is the same as the treasury worth, Bond is now not the earlier excessive premium minting, however stopped minting, indicating that earlier than the market is in inflation, the proportion of minting within the channel will progressively lower till the minting is stopped, stopping additional asset shrinkage throughout inflation.

2.2 VC Pool with All Vouchers

In line with the official doc, it’s outlined as a “VC pool with vouchers”. The doc describes: [Any project Token that enters VC Pool will undergo rigorous review and screening to prevent the malicious behavior from causing the loss of the long tail effect on potential assets, resulting in deflation and inflation of stocks (BHO) and failure to play a locking role in the Token project entering into VC Pool.

We can see that VC Pool is the asset management business.With the final stock reflected in the intrinsic value of VC Pool.

VC Pool accepts such valuable vouchers as stablecoins, NFTs and liquidity LPs. These valuable vouchers, upon up to a certain amount in VC Pool, will group LP and provide liquidity and LP loan services to the third party. All the claimed earnings will enter the VC Pool to support circulation value of the stock (BHO). Besides, one potential value of VC Pool is to serve as the credit pool. Bound with the DAOs community, it uses the DAOs community protocol to accumulate the credit and issue unsecured credit loans according to the accumulated credit.

Meanwhile, VC Pool plays a regulatory role in BHDP

- In deflation, the proportion of the stock (BHO) minted through VC pool will increase

- In inflation, the proportion of the stock (BHO) minted through VC pool will decrease

- For BHO minted through VC pool and entering VC Pool, 50% assets will be used to burn BHO in the liquidity pool. The other 50% will be kept in the pool for DAOs community credit loan.

3.0 Reverse Investment to Cater for Different Customers

3.0 Reverse Investment to Cater for Different Customers

Investment Institutions

The investment starts at 10,000 BUSD, able to receive earnings from transaction tax (BUSD+BHO)10% until the investment doubles.

DAOs Community

The investment starts at 1,000 BUSD, able to receive earnings from transaction tax (BUSD+BHO)3% until the investment doubles. The earning will stop at the end of the return period.

Individuals

The investment starts at 100 BUSD, able to receive earnings from transaction tax (BUSD+BHO)2% until the investment doubles. The earning will stop at the end of the return period.

4.0 Black Hole Reactor

The nature of the Black Hole Reactor looks like the prize pool set by the project at different stages. To meet a certain condition, the prize pool will be opened. The funds are mainly from 60% of the tax. when the market circulation reaches 10 billion BHO and the reactor amount reaches 100 million BUSD, the reactor will be opened. It’s certain that the amount varies depending on the stage of the reactor, and the amount of the reactor in the second stage maybe 1 billion BUSD.

For special reasons, there are exceptions for opening the reactor

- The reactor will be opened when the market circulation triggers the Blackhole Protocol mechanism with a final deflation to 10 billion BHO and the reactor amount reaches 100 million BUSD

- Regardless of the result, the Black Hole Reactor will be opened after 3 years.

- During the minting process, upon up to 100 million BUSD, it will open the Black Hole Reactor and stop minting.

More detailed article:https://blackholedao.substack.com/p/interpretation-of-new-defi-30-blackholedao?s=w